For those who’re studying this, you’re probably so much poorer than you assume.

Many individuals have felt that means over the previous three years due to the unusually excessive general inflation the nation has skilled. However the actual cause you’re poor has little or no to do with the costs of the previous three years — and every thing to do with the costs of the previous 30 years. That is inflation that we had been advised, for essentially the most half, had been stored low and regular. A lot of this era is made up of the “Nice Moderation,” as economists name it, a interval when it doesn’t matter what else occurred within the nation or the remainder of the world, general inflation by no means appeared to deviate a lot from the two% goal that the Fed has revered for thus lengthy.

It is a improbable story. A triumph of coverage intersecting with markets. The zenith of financial mastery. And the absolute best end result for Individuals in any respect ranges.

Too dangerous the story isn’t true.

Oh, the headline inflation numbers had been technically appropriate; that’s not the problem right here. It’s the “triumph” half. The “zenith.” The concept that the Nice Moderation was really nice, or, for that matter, reasonable. And most significantly, the suggestion that this — the economic system we’ve landed in in any case that point — is what was greatest for Individuals.

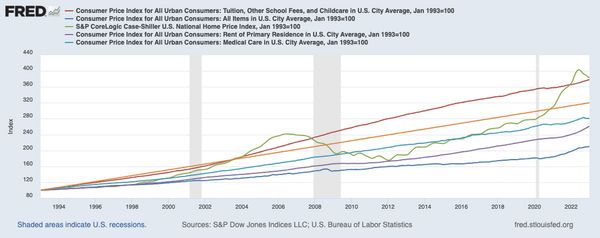

In actuality, inflation within the U.S. has been unofficially cut up into two main classes for many years: the issues we need, and the issues we want. Due largely to globalization and offshoring, the costs of the issues we need — electronics, family home equipment, off-the-rack designer clothes and so forth — have usually elevated slowly, and even gone down. In the meantime, the prices of the issues we want, like shelter or medical care — the sorts of issues that may’t be offshored and for which demand can’t fall to any substantial extent — have risen quicker than common inflation 12 months after 12 months after 12 months. At any single second in time, this isn’t notably main information, which is why the subject has garnered comparatively little consideration. “Medical Payments Expanded Considerably Quicker Than Broad Shopper Costs In 1995” isn’t a lot of a headline. However when the identical factor occurs time and again, the burgeoning buildup of the ensuing imbalances can fully reshape an economic system, even the most important economic system the world has ever seen.

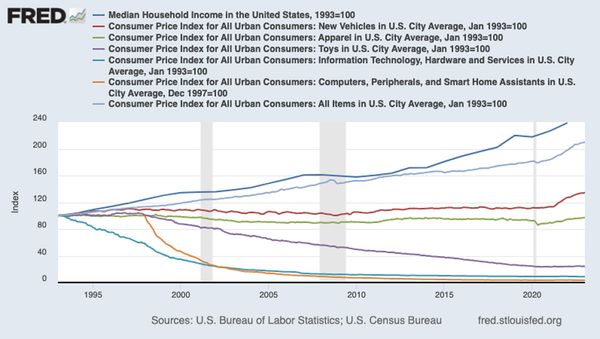

To set the stage for this retelling of historical past, it helps to know that general inflation between 1993 and 2023 totaled 110%. Hold that quantity in thoughts, as a result of many of the ones that comply with gained’t be anyplace near it.

Costs of the issues we need — electronics, family home equipment, off-the-rack designer clothes — have elevated slowly, and even gone down. However prices of the issues we want, like shelter or medical care, have risen quicker than common inflation 12 months after 12 months after 12 months.

Take new vehicles, for instance. Whereas a sure naked minimal of latest autos should be produced yearly as a way to substitute those who have completely damaged down or been destroyed, the overwhelming majority of latest automobile purchases are usually not solely fully pointless, however have been known as the one “worst funding” an individual could make by a spread of sources from Suze Orman to CNBC and even Cadillac’s personal buyer message board. A brand new automobile is a need, not a necessity. And fortuitously for individuals who have fulfilled this explicit want, the price of a brand new automobile went up by simply 34% between 1993 and 2023. In reality, till the latest spurt of widespread inflation that began in 2021, the typical worth had solely gone up by 11% over the previous 28 years.

Then there’s attire. Once more, no one would dispute the truth that a sure amount of clothes is important — however that doesn’t change the truth that an unlimited variety of U.S. purchases are superfluous. The EPA estimates that Individuals throw away greater than 17 million tons, or 34 billion kilos, of textiles yearly. That’s greater than 100 kilos for each man, girl and youngster residing within the nation. Each. Single. 12 months. These 100 kilos have to get replaced by one thing, specifically shopping for extra outfits that we put on much less typically. But even such a strong “need” has did not sustain with growing provide and reducing manufacturing prices, as the general worth of clothes has jumped little or no prior to now 30 years; the truth is, regardless of the latest spike, the typical price has really decreased by 2.5% since 1993.

That dip is nothing in comparison with the identical measurement for kids’s toys, which have plummeted in worth by a whopping 76% in the course of the timeframe in query. However the massive kahuna of client deflation is electronics. In three a long time, the price of IT {hardware} (as a broad class) and providers has fallen by 91%. The extra particular class of private computer systems, good residence assistants and “peripheral” gear has solely been tracked by the BLS since 1997, however in that point, the measure has fallen off a cliff, to the tune of 97%. TVs have gone proper over that very same cliff, simply beating out computer systems by crashing greater than 98%.

(At this level, there absolutely should be a military of naysayers asking, “How have televisions gotten that less expensive when my curved, foldable, voice-activated, 90-inch Megatron 17K Code Purple Plutonium-Plasma HHHHD Doritos Locos Excessive 5000 good TV nonetheless price me $799?” Properly, the BLS evaluates enhancements throughout all services over time, and elements these enhancements into the precise values that customers are getting for a similar primary kind of product. Simply as right now’s smartphones have tens of hundreds of occasions extra computing energy than the Apollo 11 spacecraft whereas costing thousands and thousands of occasions much less, these drastic adjustments are taken into consideration simply as a lot because the quantity on the shop tag.)

Up to now, this looks as if good news. Whereas numerous articles have been written in regards to the sluggish long-term progress of wages, median family earnings has nonetheless outpaced inflation since 1993, pushing upward by 138%. Earnings are up, and loads of costs are down. Regardless of what the celebrated economist Mick Jagger mentioned, it will seem that we can, the truth is, get what we wish.

The issue is getting what we want.

Anybody who’s purchased eggs because the COVID lockdowns started 4 years in the past would possibly suspect that on a regular basis requirements like groceries and gasoline are the primary drivers of latest poverty. However over the long run, such objects preserve tempo with the expansion of private earnings surprisingly effectively (albeit with extra volatility, within the case of gasoline) in a useful economic system, and don’t alter its elementary construction — though it’s clearly true that spikes in these costs are the almost certainly to trigger widespread anger amongst shoppers. (To cite John Schoen of NBC Information, “As anybody who drives a automobile is painfully conscious, few different merchandise require that you just stand and stare on the worth, in large lettering, for a number of minutes.”)

No, the wants which have modified American life quantity to a four-headed monster that has been fed by a perversion of market forces. For these sectors of the economic system, the fundamental relationship between producer provide and client demand merely doesn’t exist in the identical means it does for vehicles, computer systems or one model of peanut butter to a different.

The wants which have modified American life quantity to a four-headed monster that has been fed by a perversion of market forces.

The primary head is housing, the place costs have repeatedly shattered all-time highs only a decade and a half after crashing from their earlier all-time highs and sparking the worst monetary disaster because the Nice Despair. The benchmark Case-Shiller Index has risen by 306% since 1993, together with a nearly-70% leap from the pre-crisis peak in 2006, a statistic made all of the extra astonishing (or, for aspiring residence consumers, devastating) by the truth that 30-year mortgage charges hit their Twenty first-century excessive final October. Issues are, in fact, at their worst in locations like San Francisco, the place the annual earnings wanted to purchase a median-priced house is greater than $400,000 and the median month-to-month mortgage cost is over $10,000. But it surely’s not simply the most important, most costly cities the place individuals really feel this drawback; in line with property knowledge writer ATTOM, residence possession is now thought-about “unaffordable” (outlined as consuming up greater than 28% of the native median earnings) in roughly 80% of counties throughout the nation.

A lot of this displays the drastic undersupply of housing that exists all around the US due to native zoning legal guidelines, HOAs and NIMBYism. But it surely additionally has to do with the everlasting bureaucratic choice throughout each events, a number of presidential administrations and all ideologies that the federal authorities should use its monetary would possibly to “promote homeownership” — which is simply one other means of claiming “enhance demand.” In order costs went up, it was deemed mandatory that mortgage debt should develop into cheaper and simpler to entry, which made costs go up additional, which required debt to develop into even cheaper and simpler, and so forth.

The highway to hell, as they are saying, is paved with good intentions. And in a vacuum, increasing homeownership — particularly by eliminating racial redlining and different discriminatory practices — is a wonderful intention. Nonetheless, everyone knows the story main as much as 2008, and the way it turned out. The insurance policies had been profitable. Enormously profitable. Because it turned out, given the unfold of issues like “NINJA” (No Earnings, No Job or Belongings) loans and monetary merchandise with names similar to “unfunded artificial mortgage-backed securities,” a lot too profitable. Homeownership peaked in 2004, adopted by housing costs in 2006, at what had been information for every measure on the time. They hovered in place for a bit longer till the underside fell out.

A few issues occurred after that. One, the most important monetary bailouts in U.S. historical past made it clear that the federal government would do something to cease a collapse of the housing market. Two, the feds went to the identical individuals who had been being bailed out, the identical individuals who invented NINJA loans and unfunded artificial mortgage-backed securities and other forms of inscrutable monetary rubbish — Wall Avenue — and requested them for assist. Within the ashes of the disaster, Fannie Mae launched a 2012 pilot program permitting funding funds to purchase up swathes of properties that had been sitting empty after foreclosures. This effort proved exceptionally well-liked and was expanded repeatedly, offering the mandatory demand to drive housing costs skyward as soon as once more at the same time as particular person homeownership has fallen from that 2004 peak of 69% to 65%, which is the place it was in 1997.

At present, Blackstone, the most important non-public fairness supervisor on the planet, can also be America’s largest landlord. In some metro areas, similar to Atlanta, institutional buyers personal the outright majority of properties in some neighborhoods, and simply three firms personal 11% of all rental properties in the whole state of Georgia. These large-scale purchases are targeting particular areas of the nation, just like the Solar Belt. It simply so occurs that rental costs within the Solar Belt have jumped by almost twice as a lot because the nationwide common over the previous few years.

Blackstone, the most important non-public fairness supervisor on the planet, can also be America’s largest landlord. Simply three firms personal 11% of all rental properties in the whole state of Georgia.

These funding funds would say that their share of the general rental market in the whole nation remains to be small, which is true: they personal about 5% of the whole nationwide sum of single-family rental properties proper now. However they’re shopping for extra of them at a livid tempo, with MetLife projecting that the identical corporations may personal nearly half the whole inventory of such properties by 2030. This pattern, mixed with the truth that with the broader shift of thousands and thousands of individuals from homeownership again to renting, has thrown a large monkey wrench into what can be the pure market response to astronomical housing costs: Don’t purchase, lease. Properly, common rents throughout the nation (together with multi-family models) have soared by 50% since 2012, whereas private earnings has elevated by 46%. That doesn’t seem to be a catastrophic mismatch, however the issue is that purchasing a home has develop into radically costly, whereas renting a home has develop into barely costlier on the similar time. What else are individuals speculated to do?

The story is analogous on the planet of training, primarily pushed by faculties and universities, which make up a bigger portion of the BLS measurement than all different ranges of education mixed. This broad-based determine has grown by a mammoth 278% in 30 years, with college tuition dragging that determine upward, surging by 305%. By sheer lack of coincidence, solely faculty and post-graduate training could be funded by what’s successfully a limiteless type of private debt, which is tougher to discharge in chapter than nearly every other kind of debt.

Once more, as with residence possession, this isn’t to say that the aim of upper training is misguided. It’s the means we’ve determined to pay for it that’s the problem. “Scholar mortgage packages started with altruistic intent,” Hope Faculty president Matthew Scogin advised USA At present final October. “There was an issue, although. With no limits on the quantity college students may borrow, faculties and universities had a transparent path to lift the sticker worth of tuition 12 months after 12 months. After doling out all out there help, faculties merely directed college students to federal mortgage packages to shut any funding gaps — nonetheless massive.”

Whereas the federal authorities had assured a small quantity of loans made by academic establishments since 1958, then assured all pupil loans made by non-public lenders since 1965, and has outright bought a sure amount of such loans since 1972, this technique amounted to relying upon hundreds of middlemen with restricted assets and differing requirements. Washington started the method of shelling out with such middlemen and funding loans immediately, with no merit- or needs-based {qualifications} of any sort, in a wildly handy 12 months for the needs of this text: 1993. Underneath the Scholar Mortgage Reform Act of 1993, the whole sum of money that graduates owed straight to Uncle Sam went from the plain place to begin of zero to $1.62 trillion in 2023. Including within the small quantity of privately-funded pupil loans that also exist, the whole got here to $1.77 trillion, simply eclipsing the $1.03 trillion of bank card debt on the books on the time.

Nonprofit Quarterly author Steve Dubb got here to an easy conclusion when writing about how dangerous the coed debt drawback was 5 years in the past: “It’s a easy lesson — if you happen to subsidize demand however don’t have ample provide, the worth goes up… US increased training spending now’s highest on the planet (besides Luxembourg) — about $30,000 a pupil.” In his commentary, Dubb cited one of many unique architects of federal pupil loans, economist Alice Rivlin, and her opinion on the mission she pushed so onerous for in her youthful days. With these efforts, she mentioned, “We unleashed a monster.”

As soon as once more, the non-public fairness trade noticed the above tendencies and decided {that a} main stream of income was ripe for the choosing. UC Berkeley professor Charlie Eaton studied the purchases of almost 1,000 academic establishments and the ensuing results. Whereas tuition and pupil borrowing elevated extra shortly per 12 months than at comparable academic establishments not topic to that kind of possession, Eaton discovered “sharp declines” in “pupil commencement charges, mortgage reimbursement charges, and labor market earnings after non-public fairness buyouts.” However at the same time as educational budgets had been usually lower throughout the board, elevated recruiting budgets meant that there have been all the time new college students within the pipeline, and the info from these thousand colleges recommend that “income triple after a buyout.”

Need a every day wrap-up of all of the information and commentary Salon has to supply? Subscribe to our morning e-newsletter, Crash Course.

Personal fairness, Eaton concluded, simply “results in higher seize of presidency help” than different types of possession.

The same evaluation additionally applies to the numerous areas of well being care into which non-public fairness has injected itself, notably specialist fields, through which single corporations typically personal greater than half the practices of assorted specialties in whole cities, and senior care services or nursing properties, the place you — sure, you! — can purchase shares in nursing-home actual property funds, which have been nauseatingly described as “the shock heroes of high-yield investing.” However the well being enterprise as an entire and the explanations for its exploding prices are infinitely extra difficult than these present in nearly every other sector. Suffice it to say, america has conclusively confirmed {that a} Frankenstein’s monster of well being “shoppers” (a misuse of the phrase if there ever was one) who do not know what their “purchases” will really price, profit-driven non-public insurance coverage firms that pay completely different quantities to completely different suppliers for an identical care, a random mixture of private and non-private suppliers who all cost completely different quantities to completely different shoppers for a similar care, a regulatory equipment that has been fully captured by the pharmaceutical and medical gadget industries that the equipment is meant to be regulating, and a large circulate of presidency cash undergirding the entire system… doesn’t work.

You — sure, you! — can purchase shares in nursing-home actual property funds, which have been nauseatingly described as “the shock heroes of high-yield investing.”

Because the nation has stumbled its means by means of decade after decade of proving simply how a lot this assemblage of throwaway elements from a seize bag of differing well being care philosophies doesn’t work, the share of the economic system taken up by well being care spending has grown to greater than 17%, or roughly one-sixth, of our whole GDP, roughly twice the typical of OECD nations general. We spend extra per capita by far than every other nation on the planet — and but have the bottom life expectancy, highest dying fee for avoidable circumstances and highest maternal and toddler mortality of any OECD member, to not point out dozens of different statistics that paint simply as pathetic an image. This isn’t a plea for any particular substitute for the present construction of American well being care; it’s merely an affidavit to how huge a failure that present construction is. And we the individuals are paying, and even worse, not paying for it — medical payments are the No. 1 trigger of private chapter within the U.S.

Lastly, there’s the quickly accelerating price of one thing that non-parents is likely to be blissfully unaware of: youngster care. The Division of Labor declared in 2023 that, in line with its knowledge, paying for youngster care is “untenable for households throughout all care sorts, age teams, and county inhabitants sizes.” The price of care for 2 kids “exceeded the typical lease within the District of Columbia and all 49 states with out there knowledge.” That is occurring with suppliers persistently dropping employees to quick meals and big-box shops whose jobs pay higher, regardless of the outlandish costs of kid care. Treasury Secretary and former Federal Reserve chair Janet Yellen has famous that care workers solely make a mean of $27,000 a 12 months, placing them in “the underside 2% of all occupations.” In keeping with Yellen, “youngster care is a textbook instance of a damaged market.”

Sadly, there isn’t any single definition of “youngster care prices,” making it tough to trace precisely how a lot they’ve modified over time. Oddly sufficient, even sources that declare to make use of the identical knowledge from the BLS provide you with completely different numbers, and the BLS itself doesn’t seem to trace an remoted “youngster care” worth quantity each single 12 months. Most sources, nonetheless, agree that the inflation-adjusted price of such care has not less than doubled the general fee of inflation prior to now 30 years — some say it’s a lot worse than that, however this text will take the conservative strategy and merely apply the doubling statistic.

From these 4 varieties of bills for right now’s households — the 4 elementary forces of America’s modern-day family sector and the 4 horsemen of America’s slow-motion financial apocalypse — we are able to clarify why so many individuals skilled such a tough hit when eggs (these rattling eggs) doubled in worth, or on the a number of moments when gasoline costs have shot upward. Most individuals merely have a smaller share of their earnings to commit to something apart from these “elementary forces,” even supposing actual wages (minus COVID stimulus checks) are at an all-time excessive and the U.S. has the fourth-highest earnings per capita on the planet. In different phrases, being wealthy by no means felt so poor.

Most individuals merely have a smaller share of their earnings to commit to something apart from these “elementary forces,” even supposing actual wages are at an all-time excessive. Being wealthy by no means felt so poor.

The median family earned $31,240 in 1993 (in 1993 {dollars}) and earned $74,580 in 2022 (in 2022 {dollars}). If the family had one grownup who graduated from faculty in 1993, the typical pupil debt burden would have been $9,320. In 2023, it was $37,650. If this family purchased a, effectively, home, the median price in 1993 would have been $125,000; in 2023, it will have been $417,400. If the individuals of this younger family determined to have a baby early, the month-to-month price of kid care in 1993 would have been $323. Three a long time later, to make use of the tough estimate from above, the associated fee can be $1,036 monthly. And even when the members of the family had been lined by their dad and mom’ medical health insurance, they might nonetheless pay out-of-pocket prices of $2,854 for childbirth in 2023; the identical determine is tough to pin down for 1993, however since general prices (insurance coverage funds plus out-of-pocket contributions) have roughly tripled in that point, it’s an affordable guess that these providers would have are available at round $951.

No worries on that final level, nonetheless; as William Friedewald, chief medical director for MetLife again in these good ol’ days of 1993, helpfully identified, “You’ll be able to have a supply in a taxicab, and it’s free.”

Albert Einstein might not have really made his apocryphal proclamation that compound curiosity is essentially the most highly effective power within the universe, however it wouldn’t take the neatest man of the twentieth century to identify the mathematical atomic bomb slowly ticking away when the fundamental price of residing in a rustic is compounding quicker than the flexibility to make a residing in that very same nation. And whereas Einstein might get unmerited credit score for that declare, economist Herb Stein deserves actual kudos for coining one other phrase that might simply as effectively be utilized to the identical scenario: “That which can’t go on endlessly, gained’t.”

That is it: the true story of the trendy American economic system. It’s the saga of the declining prices of indulgence, overwhelmed by the rising prices of necessity. It’s the cause why millennials and Zoomers are planning for a world through which materials prosperity is not going to be decided by how a lot they’ve, however by how little they owe. It’s the sound of statistical inevitability, the sound of the dying of the American dream, ought to these tendencies proceed — finally, this technique will break down.

We are able to solely hope the subsequent one will hit a triumphant zenith that isn’t totally imaginary.

Learn extra

about inflation and the economic system