As I watched the Tremendous Tuesday returns final night time I used to be struck by exit polls that confirmed the financial system is crucial challenge to many Republican voters. They consider Donald Trump will likely be higher for them financially than President Biden. Contemplating how efficiently Biden has managed a swift restoration from the financial disaster he inherited, I discover that disturbing. But, in accordance with the New York Instances, a majority of the voters is affected by “collective amnesia” and do not bear in mind why they ousted Trump again in 2020. Apparently, they’re nostalgic for the golden days of a Trump administration that by no means existed.

I do not know if that amnesia will likely be cured by details and statistics, however even Fox Information has to confess that the Biden financial system is doing very effectively.

Nonetheless, Trump and all of his numerous henchmen spend their days insisting that the financial system is on the breaking point. Final night time, throughout his low-energy victory speech, Trump stated it as soon as once more and as he advised Lou Dobbs in an interview in January, he hopes the financial system will crash throughout the subsequent 12 months in order that he will not be like Herbert Hoover. (Joe Biden accurately identified to Evan Osnos within the New Yorker, “He’s already Herbert Hoover. He’s the one President that ever misplaced jobs in a four-year interval—aside from Hoover.”)

Although inflation has stopped rising on the similar tempo as a few years in the past, folks yearn for costs to return all the way down to the place they have been earlier than the pandemic. And simply as he promised again in 2016, Trump says that solely he can repair it. However he is quick on particulars about how he is going to try this apart from some imprecise guarantees to dramatically increase tariffs and deport hundreds of thousands of undocumented staff which is able to really ignite inflation. And he has stated that he’ll totally fund Social Safety and Medicare by way of “development” and promoting oil leases in Alaska which could as effectively be a promise to pay for it with diamond mines on Mars.

He does have one different plan that he would not speak about fairly as a lot, nonetheless. Right here he’s sharing it with a gaggle of rich donors at Mar-a-Lago again in December. “You are all those that have some huge cash. You are wealthy as hell. We’re gonna offer you tax cuts,” he advised them.

In fact he’s. And he is planning to chop company taxes too. He is a Republican and that is what they do.

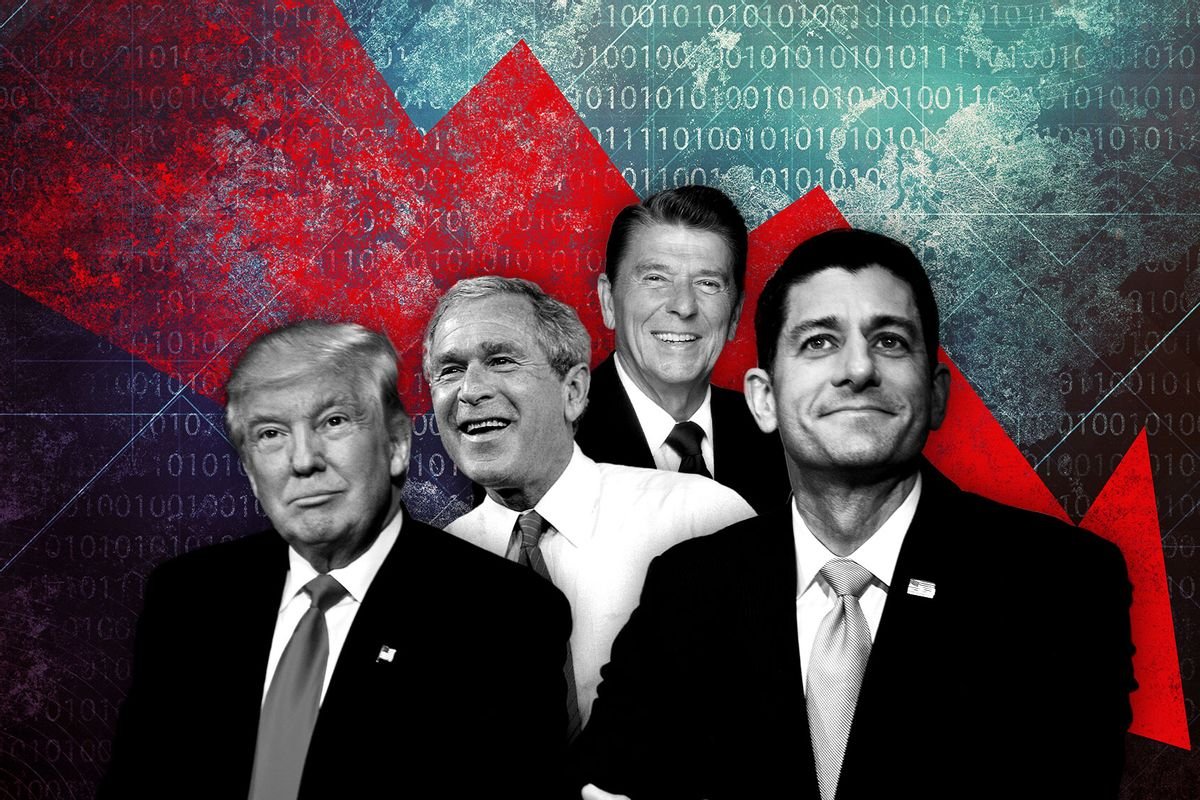

Donald Trump’s solely legislative accomplishment in his first time period was a large tax minimize invoice for the wealthy. However that wasn’t actually his accomplishment, was it? That was the evergreen coverage purpose of the Republican Social gathering, particularly the blue-eyed dream boat Speaker of the Home Paul Ryan, the Ayn Rand devotee who believed that wealthy males have been heroes who wanted to be allowed to run free and unencumbered by civic accountability in order that capitalism would possibly save humanity. That the Republican tax minimize personally benefited the brand new, rich president made it all of the sweeter.

Trump’s dedication to decrease taxes for the wealthy is a given. All the pieces he does is at first for himself and he will not even attempt to rationalize it. It is unlikely that the remainder of the celebration can get away with that, in order that they’ll little question return to their perennial excuse — the federal finances deficit as a motive to decrease taxes, though that is unnecessary.

That drained outdated noticed goes again to the Reagan administration which popularized a quack idea referred to as “provide aspect economics” championed by economist Arthur Laffer. He claimed that the extra you chop taxes the better the income to the federal government. Even then everybody knew it was ridiculous. Reagan’s finances director, David Stockman, really spilled the beans to journalist William Greider, telling him, “It is type of onerous to promote ‘trickle down, so the supply-side components was the one technique to get a tax coverage that was actually ‘trickle down.’ Provide-side is ‘trickle-down’ idea.” Trump gave Arthur Laffer the Presidential Medal of Freedom in 2019.

At this time one other provide aspect guru, Stephen Moore, previously of the Membership for Development, has co-authored the Mission 2025 financial plan to utterly “reform” the U.S. Treasury. He is pushing to denationalise Social Safety which Trump has by no means explicitly dominated out and advised The Guardian, “Sure, I’m strongly in favor of chopping tax charges to make [the] American financial system No 1.” And this could presumably be along with extending the Trump tax cuts from 2017 that are up for renewal subsequent 12 months.

Simply this week, we have obtained some vital information on the impact of these tax cuts and I am positive you will not be stunned to be taught that they didn’t pay for themselves or ship the 1000’s of {dollars} in elevated wages to staff as promised. The New York Instances stories:

As an alternative, they’re including greater than $100 billion a 12 months to America’s $34 trillion-and-growing nationwide debt, in accordance to the quartet of researchers from Princeton College, the College of Chicago, Harvard College and the Treasury Division.

The researchers discovered the cuts delivered wage positive factors that have been “an order of magnitude under” what Trump officers predicted: about $750 per employee per 12 months on common over the long term, in comparison with guarantees of $4,000 to $9,000 per employee.

Desire a day by day wrap-up of all of the information and commentary Salon has to supply? Subscribe to our morning e-newsletter, Crash Course.

That trickle by no means appears to make it down from the rich’s palatial palaces, as CBS Information outlines additional:

The brand new paper, by David Hope of the London Faculty of Economics and Julian Limberg of King’s Faculty London, examines 18 developed nations — from Australia to america — over a 50-year interval from 1965 to 2015. The examine in contrast nations that handed tax cuts in a particular 12 months, such because the U.S. in 1982 when President Ronald Reagan slashed taxes on the rich, with those who did not, after which examined their financial outcomes.

Per capita gross home product and unemployment charges have been almost equivalent after 5 years in nations that slashed taxes on the wealthy and in those who did not, the examine discovered.

However the evaluation found one main change: The incomes of the wealthy grew a lot quicker in nations the place tax charges have been lowered. As an alternative of trickling all the way down to the center class, tax cuts for the wealthy might not accomplish rather more than assist the wealthy preserve extra of their riches and exacerbate revenue inequality, the analysis signifies.

That is nothing however a giveaway to their wealthy benefactors. It is a con that is been working superbly for 50 years.

Apparently, Trump simply welcomed one of many two richest males on this planet, Elon Musk, a significant authorities contractor and social media influencer, to Mar-a-Lago to beg for cash. Contemplating the batshit lunacy that Musk is posting to his X account lately, Trump can in all probability rely on him for a billion {dollars} or so. Each of those males are shallow thinkers who’ve adopted the personas of populist demagogues talking for the working man towards the elites however in the long run, they’re simply a few wealthy guys searching for primary. Beneath all of the MAGA bluster and BS, it is nonetheless the Republican Social gathering — and the politicians will at all times cater to them that brung ’em.

Learn extra

about this subject